Author: Robert Longyear, Vice President of Wanderly Digital Health and Innovation

The COVID-19 pandemic has impacted how patient care is delivered in both outpatient health care practices and inpatient facilities. To decrease the risk of virus exposure and transmission among patients and healthcare professionals, providers are deferring elective and non-emergency visits, such as annual physicals.

When possible, providers are utilizing telehealth to fill the gaps for patients, but many procedures and hands-on visits have been postponed. Both government regulations and provider decisions have significantly impacting visit volumes. In addition, many patients are also avoiding visits because they do not want to risk exposure. The impact on the staffing industry due to these three factors has been tremendous.

This underlying demand reduction for healthcare procedures has reduced job openings for staffing in areas hit hard by these visit reductions. During the peak of COVID-19, this impact was delayed and is being felt currently. However, recent data is starting to indicate a rapid rebound in elective procedures. Data, recently published by the Commonwealth Fund, indicates an increasing volume of in-person visits as facilities begin to open and patients gain confidence returning to their local providers for care.

The Data

“Researchers at Harvard University and Phreesia, a health care technology company, analyzed data on changes in visit volume for the more than 50,000 providers that are Phreesia clients. During the study period (mid-February to mid-May) there were more than 12 million visits. The following charts illustrate how declines in visits vary by patient type, geographic area, clinical specialty, and size of provider organization. Details on data sources, analyses, and study limitations are available at the bottom of this post.”

The Impact on Staffing

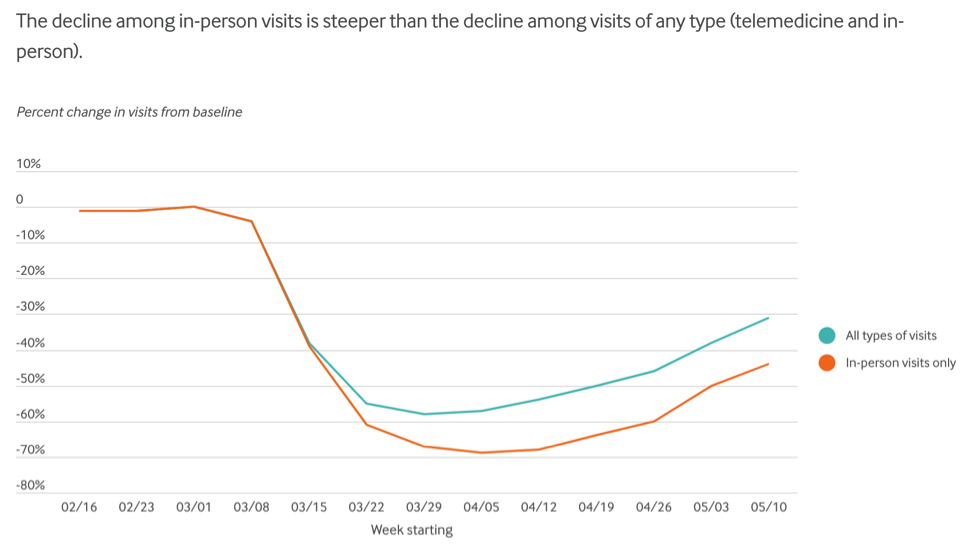

In Figure 1, below, the trend in healthcare visits is plotted from mid-February through early May. Here, during the peak of the coronavirus, we can see an approximately 70% reduction in in-person visits.

This impact was felt by the staffing industry when hospital revenue took a significant hit as high-revenue surgical procedures and many other service lines went offline. Besides the high demand for “hotspot ICU” and respiratory therapists in response to COVID-19, most of the country’s health systems responded through a hiring freeze, reduction in contingent staffing, and even furloughing permanent employees.

While these impacts are still being felt, the period from early April through early May shown in the figure below shows a rapid increase in visits rebounding from the previous lows. If this trend continued through June, we can expect a significant increase in in-person visits in June and July 2020.

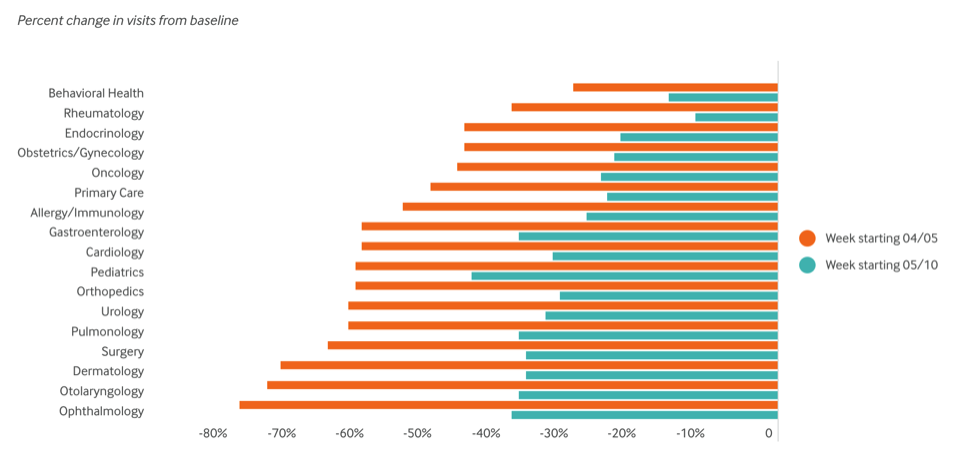

In Figure 2, below, we can see the percent change from baseline across medical specialties. Here we can see that the primarily outpatient and “chronic care” specialties were able to maintain more visits than those that are more procedure-based like the surgical specialties.

The major trend as it relates to the contingent staffing industry is the rebound from the orange lines representing April 5th to the green lines that show data as of May 10th. Here we can see a relatively uniform rebound in visits from the April peak of coronavirus through May 10th.

As surgical volumes begin to increase and facility-based care returns to pre-COVID levels, we can expect facilities to begin opening up jobs to meet the pent-up demand for postponed procedures.

Hospital service line managers will be under pressure to ensure efficiency and fast return to normal volumes. This management pressure will likely result in a fast rebound from May through present time. If this trend continued, we should be approaching visit numbers closer to baseline in the coming months.

Conclusion

There are many factors that will impact contingent healthcare staffing as it relates to COVID-19. Government responses, public health interventions, patient attitudes, and health system volumes will be major drivers of the period after the spring peak of COVID-19.

For staffing agencies, monitoring national visit-volume data and projections can offer a window into the future demand for nurses, allied health professionals, and other contingent healthcare professionals.

—

Wanderly has been monitoring the underlying drivers of the staffing industry to better understand the impacts of COVID-19. Through our internal data and reviews of external health system data sets, we are watching closely to ensure we are prepared to support the needs of our partners. As data continues to emerge, we will continue to update through our network and distribution channels.

References

Source: Ateev Mehrotra et al., “The Impact of the COVID-19 Pandemic on Outpatient Visits: A Rebound Emerges,” To the Point (blog), Commonwealth Fund, May 19, 2020. https://doi.org/10.26099/ds9e-jm36